Business Registration Form

This business registration form can be used whoever needs to get new business clients on their website. It provides a general framework for capturing all business information required for processing. Example uses include: agents offering insurance to businesses, or CPAs offering tax services, or law firms offering business law services.

Business Registration Form FAQs

A Business Registration Form is an official document required by governmental authorities that serves to formalize the establishment of a new business entity. This form typically collects pertinent information about the business, including its name, legal structure (such as a corporation, partnership, or sole proprietorship), physical address, and the names of the owners or directors. Additionally, the form may require details concerning the nature of the business and its intended operations. Completing this form is a crucial step in ensuring compliance with local, state, and federal regulations, allowing the business to operate legally within its jurisdiction. Thoroughly completing the Business Registration Form also facilitates the process of obtaining necessary permits, licenses, and tax identification numbers, which are critical for smooth business operations.

A Business Registration Form is a critical document for formally establishing a business entity and typically should contain the following key components to ensure comprehensive and compliant registration:

Business Name: The chosen name of the business, ensuring it is unique and complies with the regulations of the jurisdiction.

Business Structure: The legal structure of the business, such as sole proprietorship, partnership, corporation, or limited liability company (LLC).

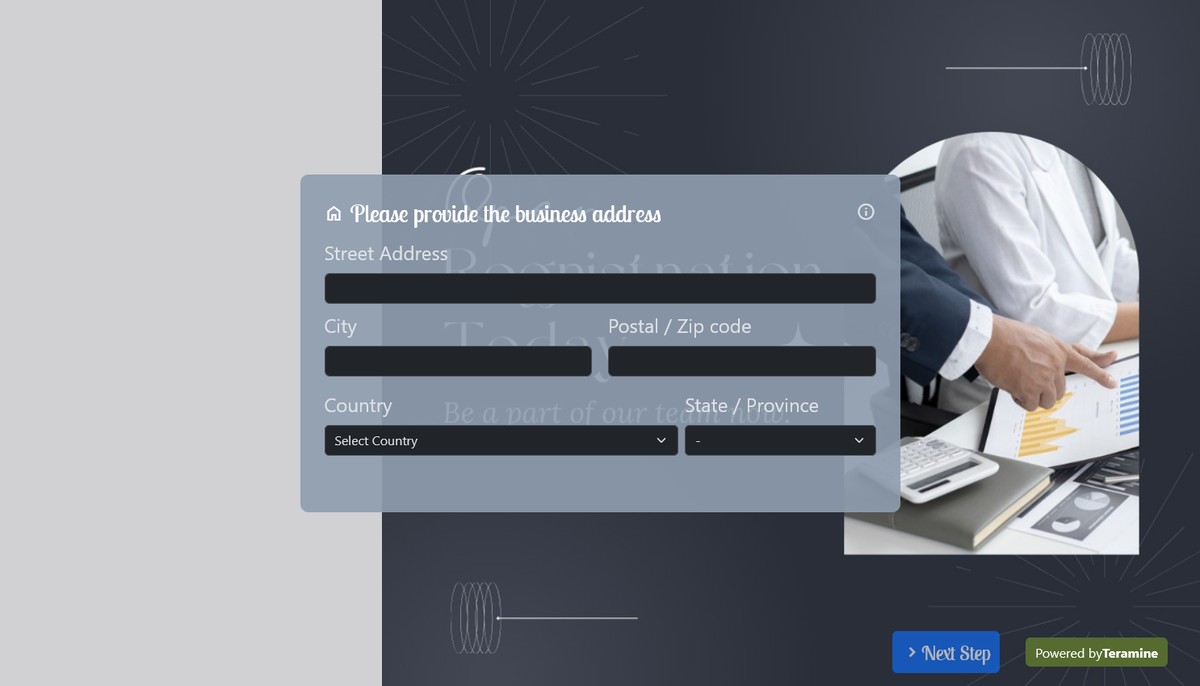

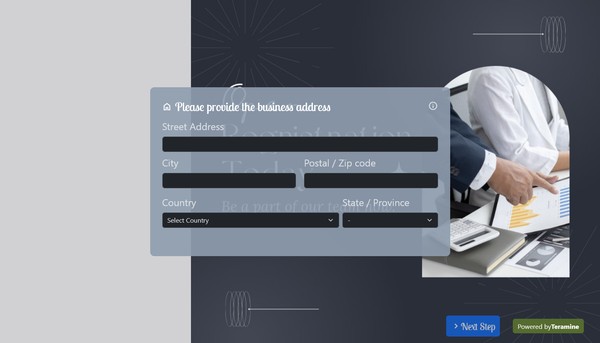

Principal Business Address: The physical location where the business will operate, along with any additional locations if applicable.

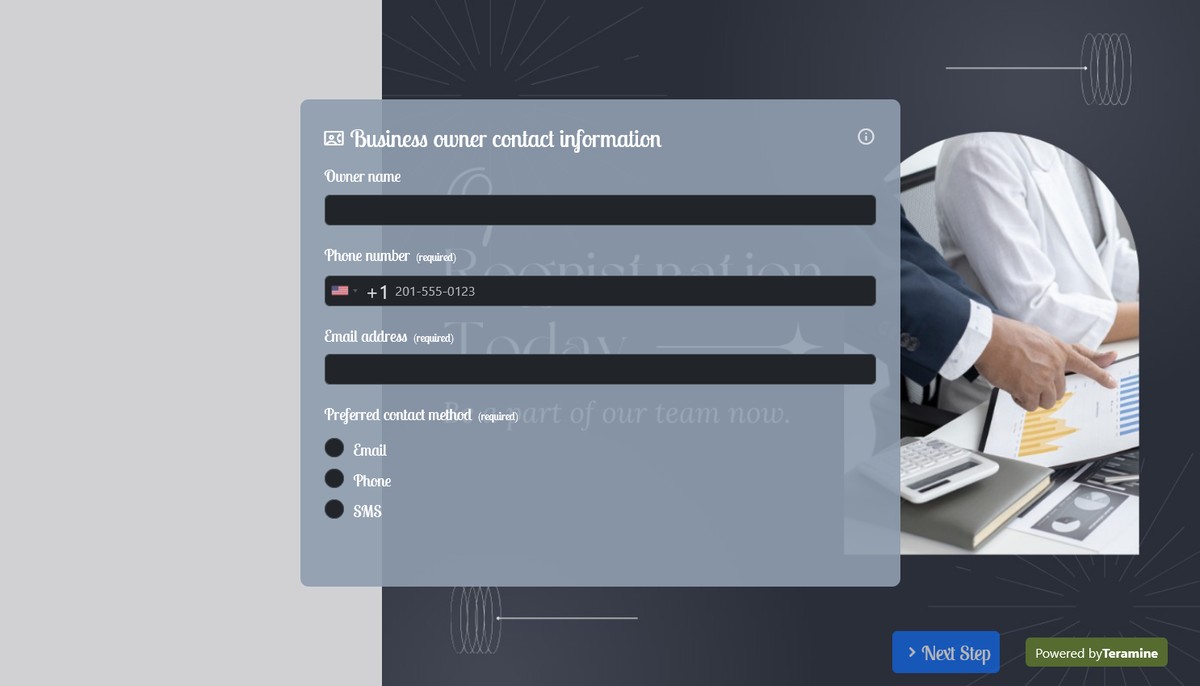

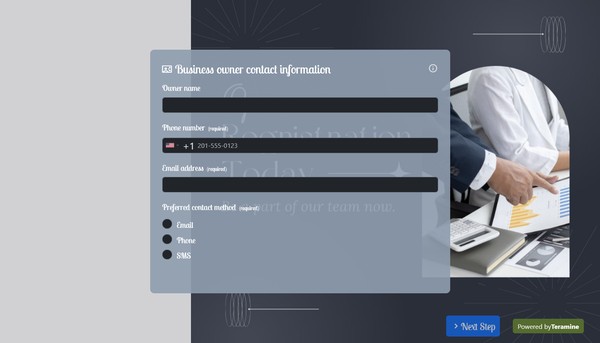

Contact Information: Primary contact details, including phone number and email address.

Owner/Partners Information: Names, addresses, and identification numbers of the owner or partners involved in the business.

Nature of Business: A description of the products or services offered, often including an industry classification code (e.g., NAICS or SIC code).

Registered Agent Details: Information about the registered agent who will receive legal documents on behalf of the business.

Tax Information: Information required for tax purposes, including Employer Identification Number (EIN) if applicable.

Date of Commencement: The proposed date when the business operation will officially begin.

Signatures: Authorized signatures of the business owners or representatives, certifying the accuracy of the information provided.

Payment Information: Details related to registration fee submission, including methods of payment.

Supporting Documents: Any required attachments, such as proof of address, identity verification, or incorporation documents, depending on the jurisdiction’s requirements.

These elements ensure that the business is properly registered and complies with the local laws and regulations, laying a solid foundation for legitimate operations.

Utilizing a Business Registration Form comes with several advantages that significantly enhance operational efficiency and legal compliance for any enterprise. Here are some key benefits:

Legal Compliance: Registering your business ensures compliance with local, state, and federal regulations, helping to avoid potential legal issues and penalties.

Establishing Credibility: A formally registered business appears more legitimate and trustworthy to customers, partners, and various stakeholders.

Protecting Business Name and Brand: Business registration protects your company's name from being used by other entities within the jurisdiction, safeguarding your brand identity.

Access to Funding and Resources: Many financial institutions and investors require businesses to be registered before providing loans or investment. A registered status can also facilitate access to government grants and programs.

Owner’s Liability Protection: For certain business structures like LLCs or corporations, registration provides a layer of protection for personal assets against business liabilities.

Tax Advantages: Registered businesses can take advantage of various tax deductions and benefits that are not available to unregistered entities.

Hiring Employees: Registration is often a prerequisite for hiring employees, enabling you to obtain an Employer Identification Number (EIN) for tax reporting.

Simplified Transactions: Having official documentation allows businesses to open corporate bank accounts, process payments more efficiently, and enter into contracts.

Overall, registering your business is a strategic step that can greatly enhance its operational capacity and market presence.